estate tax return due date canada

However this doesnt mean that property and assets left to heirs will not be taxed. These taxes are applied before the estate is distributed.

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

For a T3 return your filing due date depends on the trusts tax year-end.

. Filing dates for 2021 taxes. Chart indicating the due date for the final return based on the date of death. Deadline to contribute to an RRSP a PRPP or an SPP.

The final return can be E-filed or. Do not assume that the estate T3 return has the same April 30 filing deadline as regular T1 returns. However a trust or an estate may also have an income distribution deduction for distributions to beneficiaries.

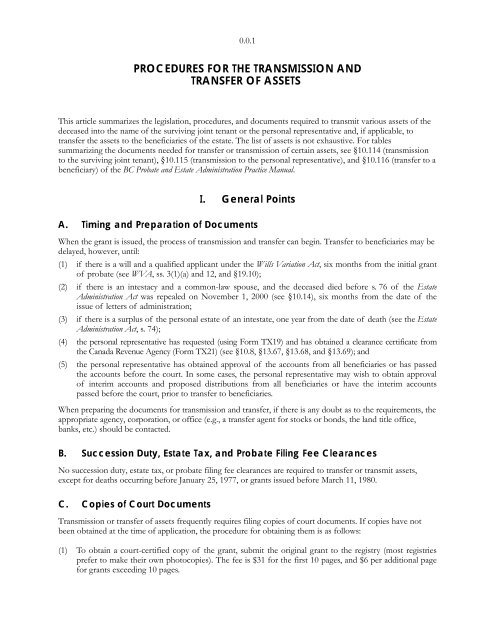

15 the due date for the final. Beginning January 1 2020 an Estate Information Return must be received by the Ministry of Finance within 180 calendar days of the date the estate certificate was issued. Tax Deadline 2023 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips The Best Online Tax.

In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4. However there are certain exceptions. Estate tax return due date canada Wednesday October 19 2022 Edit.

4- Pay or secure all amounts owing. For a T3 return your filing due date depends on. On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death.

Any taxes owing from this tax return are taken from the estate before it can be settled dispersed. The appropriate tax-return deadline depends on whether the taxpayer is an individual a deceased individual a corporation or a trust or estate. Report income distributions to beneficiaries and to the IRS on Schedule K-1.

Each type of deceased return has a due date. When are the returns and the taxes owed due. If a person dies after October 1 their legal representative has 6.

If the death occurred between January 1st and October 31st you. If the death occurred between january 1 and october 31 inclusive the due date for the final return is april 30 of the following year. The due date of this return depends on the date the person died.

Its as if the deceased were being. Generally the terminal return is due on April 30 of the year following a persons death. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

This varies by state - in New York for example if value is over 593 million a return must be filed. For instructions on completing a return see How to complete the final return. The estate T3 tax return reports income earned after death.

Matthews estate T3 return reports 2500 income from the lump sum CPP. Deadline to file your taxes. April 30 2022 or June 15 2022 if the deceased was a self-employed individual although any balance owing is still due on April 30 6 months after the date of death.

The date that is 90 days after the assessment date is August 30 2018. The final return can be E-filed or. Apr 30 2022 May 2 2022 since April 30 is a Saturday.

File your return early or before the due date to avoid being. An individualie a natural. Report income earned after the date of death on a T3 Trust.

Estate tax returns are due 9 months after the date of death with a 6 month extension available upon request estimated payment still required within the original 9 months. For most people the 2021 return has to be filed on or before April 30 2022 and payment is due April 30 2022. First there are taxes on income or on.

January 1 to December 15 of the year. New Irs Guidance Expands Tax Deadlines Deferred To July 15 Tax Deadline 2023 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips Form 709 The U S Gift Tax Return For Expats H R Block. You have to file this optional return and pay any amount owing by the later of.

Period when death occurred Due date for the final return. For example a July 1 2020 - June 30 2021 filing period means the return is due September 30 2021.

Due Dates To File Income Tax Return For Fy 2021 22 Ay 2022 23

All The Tax Filing Deadlines You Need To Know

2020 Tax Filing Due Dates Thompson Greenspon Cpa

How Do Quarterly Income Tax Installments Work Moneysense

Emancipation Day Delays Tax Return Filing Due Date Wolters Kluwer

Cra The Pursuit Of The Beneficiary Of Your Life Insurance

Estate And Inheritance Taxes Around The World Tax Foundation

Everything You Need To Know About Netfile H R Block Canada

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

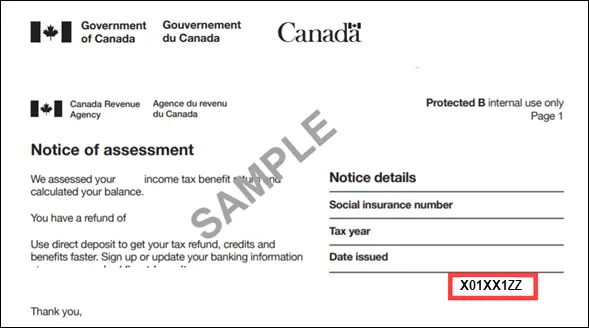

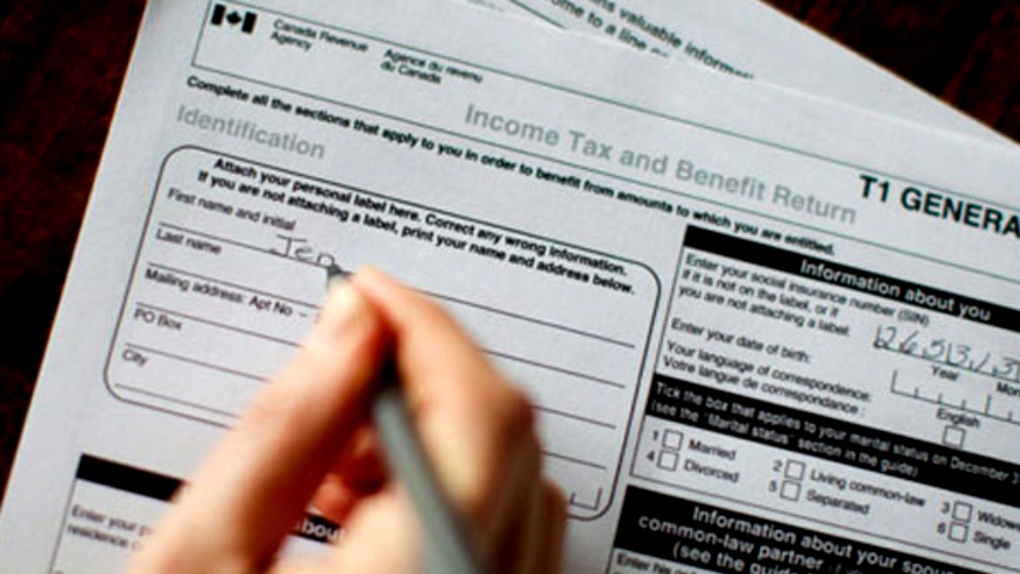

What Is A Notice Of Assessment Noa And T1 General Filing Taxes

Estate And Inheritance Taxes Around The World Tax Foundation

How Estate And Inheritance Taxes Work In Canada

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

Coronavirus Everything You Need To Know About Covid 19 And Your Taxes Explained Ctv News

Procedures For The Transmission And Transfer Of Assets

How To Claim Rent On Taxes In 2022 Filing Taxes

Closing Up Shop Baker Tilly Canada Chartered Professional Accountants

Taxes For Canadian Citizens Living In The Us 101 Tfx

Applying For A U S Tax Identification Number Itin From Canada Us Canadian Cross Border Tax Service Cross Border Financial Professional Corporation